The European Accessibility Act (EAA) is reshaping the financial sector, requiring banking software providers to implement accessibility features that enable inclusive digital banking. With the June 28, 2025 deadline fast approaching, banks and financial institutions must align their software solutions with EAA regulations to avoid legal risks and enhance customer satisfaction.

For self-service banking applications, such as ATMs, online banking portals, and point-of-sale (POS) terminals, compliance means integrating text-to-speech (TTS), keyboard navigation, high-contrast interfaces, and privacy-enhancing features. This article provides a detailed overview of how banking software can be optimized for EAA compliance.

What Does the European Accessibility Act Mean for Banking Software?

The EAA (EU Directive 2019/882) mandates that financial services must be accessible to people with disabilities, ensuring that digital transactions, ATM interactions, and online banking services are easy to use for visually impaired, hearing-impaired, and mobility-restricted users.

Key Accessibility Requirements for Banking Software

Alternative Input Methods – Users must be able to navigate banking software via physical keypads, voice commands, or assistive technologies.

High-Contrast & Readable Fonts – Ensuring high-contrast modes, larger fonts, and color-coded accessibility indicators.

Text-to-Speech (TTS) Integration – For blind users, software must provide spoken instructions and real-time audio feedback.

Keyboard-Only Navigation – Users should be able to perform transactions without requiring a touchscreen.

Extended Session Timers & Warnings – Software should alert users before timeouts and allow for extensions.

Failure to comply with these core accessibility principles could lead to fines, legal action, and reputational damage for non-compliant banks and financial institutions.

How the EAA Impacts Banking Software Development

1. Accessibility for Self-Service Banking Terminals (ATMs, POS, and Kiosks)

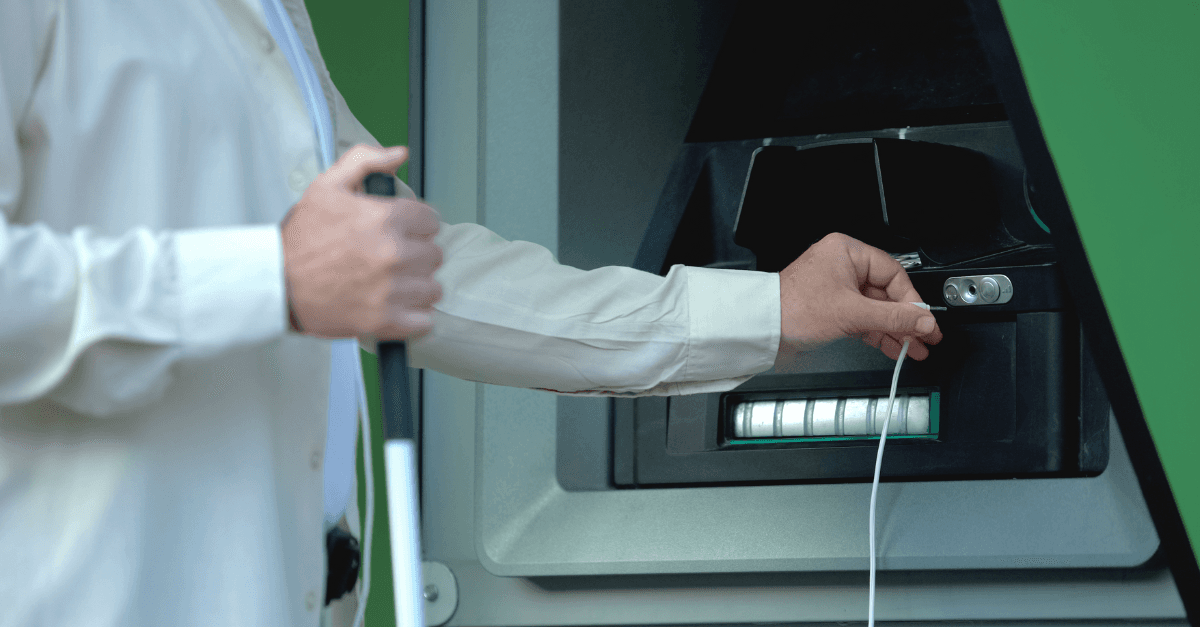

Self-service banking kiosks, including ATMs, point-of-sale (POS) devices, and self-checkout systems, must integrate accessibility features such as:

Enhanced PIN Entry: Users should be able to enter PINs using alternative input methods (e.g., keypad-based entry or T9-style typing for visually impaired users).

Audio Assistance via Headphones: When a user plugs in headphones, the machine must activate TTS and automatically hide sensitive on-screen data.

Privacy Protection: Banking software must prevent shoulder-surfing by disabling on-screen text when accessibility features are active.

2. EMV Kernel Compliance and Card Payment Accessibility

The EMV Kernel is the core component that processes smart card payments in banking applications. To meet EAA compliance, chip-based payment systems must:

Support secure PIN entry for visually impaired users.

Offer keyboard-based transaction navigation.

Ensure compatibility with screen readers and voice assistance.

The latest EMV Kernel updates (Version 4.08) introduce improvements in Extended Data Authentication (XDA), Offline Data Encipherment (ODE), and better transaction security to align with EAA and WCAG standards.

3. High-Contrast UI and Large Fonts for Digital Banking

For online banking platforms and mobile banking apps, software providers must implement:

Dark mode and high-contrast themes.

Scalable fonts that can be adjusted without breaking the layout.

Readable fonts such as Atkinson Hyperlegible to improve readability for visually impaired users.

4. Keyboard Navigation & Screen Reader Compatibility

To support users who cannot operate a mouse or touchscreen, banking software must allow keyboard-only operation with clear focus indicators. Additionally:

Voice-enabled banking software should integrate natural language processing (NLP) for voice-activated transactions.

Screen readers (NVDA, JAWS) must be able to read transaction summaries, balance details, and confirmation screens.

5. Secure and Accessible Two-Factor Authentication (2FA)

Security measures, such as two-factor authentication (2FA) and biometric verification, must be designed with accessibility in mind. For example:

One-time passwords (OTPs) should be read aloud for visually impaired users.

Biometric logins must provide alternative login methods (e.g., PIN entry or security questions).

Frequently Asked Questions (FAQs) on EAA Compliance for Banking Software

1. Which banking software needs to be EAA compliant?

All digital banking platforms, including ATMs, mobile banking apps, online banking portals, and POS terminals, must comply with EAA regulations.

2. What happens if a bank doesn’t comply with the EAA?

Failure to comply by June 28, 2025, may lead to:

Fines & penalties imposed by EU regulators.

Legal restrictions on offering non-compliant services.

Loss of customer trust and reputational damage.

3. How can banks test if their software meets EAA standards?

Banks should perform:

Accessibility audits using WCAG 2.2 guidelines.

User testing with disabled customers to identify barriers.

Software certification through accessibility compliance firms.

4. Does the EAA apply to third-party fintech providers?

Yes, all financial service providers, including banks, fintech companies, and third-party payment processors, must comply.

5. What are the key accessibility tools for banking software developers?

WebAIM Contrast Checker (for UI contrast testing)

NVDA & JAWS (for screen reader compatibility)

Gallit-Testtools (for ATM & POS accessibility testing)

Conclusion: EAA Compliance as a Competitive Advantage in Banking

Rather than viewing the European Accessibility Act as merely a compliance requirement, banks should leverage it as an opportunity to differentiate their digital banking experience. By ensuring accessibility, financial institutions can:

✅ Expand their customer base to millions of disabled users.

✅ Enhance security and usability with voice navigation, screen readers, and keyboard shortcuts.

✅ Future-proof their technology to align with global accessibility trends.

With EAA-compliant banking software, financial institutions can drive innovation, customer satisfaction, and inclusivity—while avoiding legal risks.

Sources

This article is based on official European legislation, industry best practices, and financial accessibility guidelines. Below are three key sources:

European Accessibility Act (EAA) - EU Directive 2019/882

The official legislation defining accessibility requirements for digital banking, ATMs, and financial services across the EU.

Web Content Accessibility Guidelines (WCAG 2.2)

The global standard for accessible digital interfaces, referenced in the EAA for self-service banking applications.

EMV® Integrated Circuit Card Specifications for Payment Systems (Version 4.4)

The latest EMV Kernel security and accessibility updates for card payment systems, ATMs, and POS terminals.