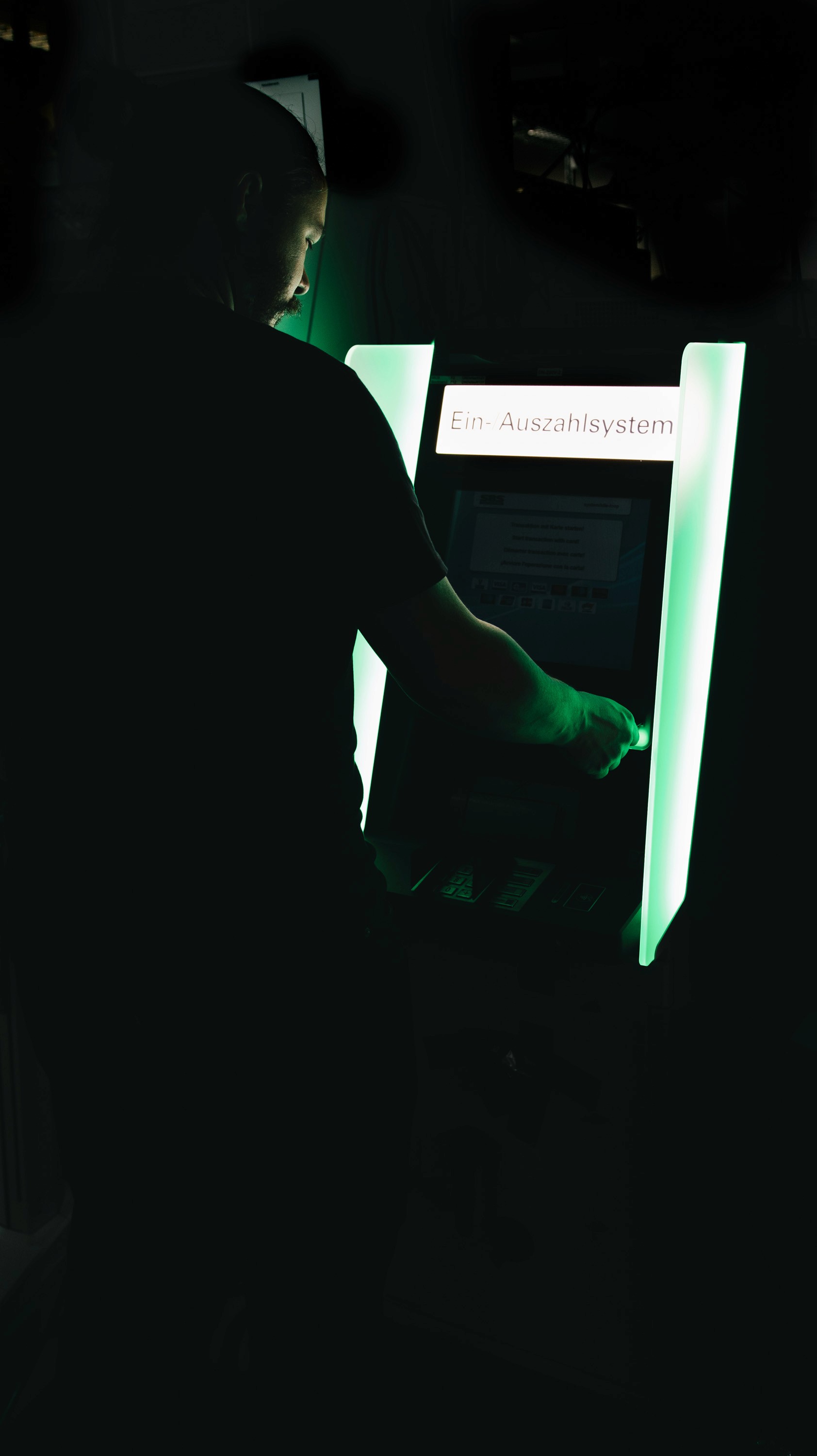

As financial services move towards cloud-based, managed solutions, ATM as a Service (ATMaaS) is gaining momentum. This model enables banks and financial institutions to outsource ATM operations while focusing on customer experience and efficiency. However, with this shift comes a critical challenge: ensuring PCI DSS compliance.

Payment Card Industry Data Security Standard (PCI DSS) is a set of security requirements designed to protect cardholder data from breaches and fraud. For businesses leveraging ATMaaS, failing to comply with PCI DSS can result in hefty fines, reputational damage, and increased security vulnerabilities.

So, how does PCI DSS apply to ATM as a Service? What are the key requirements, and how can businesses stay compliant? This article covers everything you need to know about PCI DSS compliance in ATMaaS and provides actionable insights for financial institutions.

Understanding PCI DSS and Its Importance in ATM as a Service

PCI DSS is a global standard mandated by payment brands like Visa, Mastercard, and American Express to safeguard credit card transactions. Compliance is essential for all entities involved in processing, storing, or transmitting cardholder data—including those operating ATMs.

Why PCI DSS Compliance Matters for ATMaaS

Protects Cardholder Data – Encryption, tokenization, and secure networks minimize fraud risks.

Avoids Legal and Financial Penalties – Non-compliance can lead to fines of up to $500,000 per breach.

Maintains Customer Trust – Consumers expect secure transactions 24/7.

Ensures Business Continuity – A data breach can disrupt services and lead to revenue loss.

Meets Regulatory Requirements – PCI DSS compliance aligns with GDPR, PSD2, and local banking regulations.

Frequently Asked Questions About PCI DSS in ATM as a Service

1. Who is Responsible for PCI DSS Compliance in ATMaaS?

With ATMaaS, compliance responsibility is shared between banks, ATM service providers, and third-party vendors. Key stakeholders include:

Financial Institutions – Ensure their ATMaaS provider meets PCI DSS standards.

ATMaaS Providers – Maintain secure networks, encryption protocols, and compliance certifications.

Third-Party Vendors – Include payment processors, software providers, and cloud service operators.

A Service Level Agreement (SLA) should clearly define roles, responsibilities, and compliance expectations.

2. What Are the Key PCI DSS Requirements for ATMaaS?

PCI DSS includes 12 core requirements, but in the context of ATM as a Service, the most critical include:

✅ Requirement 1: Secure Network Architecture

Firewalls must be configured to protect ATM networks from cyber threats.

ATM transactions should be segmented from other banking operations.

✅ Requirement 3: Encrypt Cardholder Data

ATMs must use AES-256 encryption for cardholder data.

Data should never be stored unencrypted.

✅ Requirement 5: Protect Systems Against Malware

ATM software must have real-time antivirus protection.

Regular patch updates are mandatory.

✅ Requirement 7: Restrict Access to Cardholder Data

Role-based access controls (RBAC) should be implemented.

Only authorized personnel should have physical or digital access.

✅ Requirement 9: Physical Security of ATMs

Surveillance, anti-skimming devices, and security seals prevent unauthorized access.

Secure vaults must store ATM hardware and cash reserves.

✅ Requirement 11: Regular Testing & Audits

Quarterly penetration testing must be conducted.

Security logs should be monitored 24/7 for anomalies.

3. How Do You Maintain Ongoing PCI DSS Compliance?

PCI DSS compliance is not a one-time certification—it requires continuous monitoring and updates. Best practices include:

Regular Risk Assessments – Identify vulnerabilities in ATM networks and data flows.

Automated Compliance Monitoring – Use AI-driven security tools to detect anomalies in real-time.

Employee Training – Staff should be trained on ATM security policies and phishing threats.

Incident Response Plan – Have a breach response plan to mitigate damage quickly.

Annual PCI DSS Certification – Ensure all third-party service providers are re-certified annually.

Future Trends in PCI DSS and ATM Security

As cyber threats evolve, PCI DSS will continue to adapt. Some key trends shaping PCI compliance in ATMaaS include:

Biometric Authentication – Future ATMs will rely on fingerprint and facial recognition instead of PINs.

Cloud-Based ATM Security – ATMaaS providers will leverage cloud monitoring to detect fraud attempts in real-time.

AI-Powered Threat Detection – AI will predict fraudulent transactions before they occur.

Tokenization for Cardholder Data – Sensitive cardholder data will be replaced with secure tokens, reducing breach risks.

Contactless ATM Transactions – NFC-enabled ATMs will eliminate physical card skimming threats.

Conclusion

PCI DSS compliance is non-negotiable for ATM as a Service providers. As financial institutions increasingly outsource ATM operations, ensuring a secure, compliant infrastructure is crucial to avoiding breaches, fines, and reputational damage.

By following PCI DSS best practices, leveraging AI-driven monitoring, and collaborating with compliant vendors, banks can ensure that ATMaaS solutions remain secure and future-proof.

Sources

PCI Security Standards Council – www.pcisecuritystandards.org

Visa PCI Compliance Guidelines – www.visa.com

Mastercard PCI DSS Compliance – www.mastercard.com